Opening a branch in Portugal in 2024 is not a complex procedure and such an entity can be completed in just a few days. Even though the foreign company is fully liable for its actions, it is considered an advantageous form of business, particularly from the financial point of view. Our company formation specialists in Portugal are at your service if you would like to know the requirements for opening a branch in this country, plus details about the tax structure.

| Quick Facts | |

|---|---|

| Applicable legislation |

For foreign countries |

|

Best used for |

– banking, – insurance, – varied financial operations |

|

Minimum share capital |

No |

| Time frame for the incorporation (approx.) |

Around 4 months |

| Management |

Local |

| Legal representative required |

Yes |

| Local bank account |

Yes |

| Independence from the parent company | Dependent on the parent company |

| Liability of the parent company | Full liability on the branch office's debt and obligations |

| Corporate tax rate | 21% |

| Possibility of hiring local staff | Yes |

Do I need a minimum share capital for opening a branch in Portugal?

There is no need to subscribe a minimum share capital at registration of the Portuguese branch. It is good to know that the invested capital comes only from the parent company. The assets are also provided by the parent company and, if an authority asks the branch to present a list with its assets, all the properties of the foreign company will have to be included. The major decisions of a branch, especially related to acquiring assets and shares, must receive the confirmation from the overseas company.

Do you need other types of services in Portugal, such as immigration services? Our partners from Immigrate-Portugal.com can assist you.

Branches of foreign associations or foundations can also be established in Portugal. A foreigner can be a representative agent for such an entity if he or she obtains the NIF, which is the Portuguese Taxpayer Number issued for non-residents.

What are the requirements for branches in Portugal in 2024?

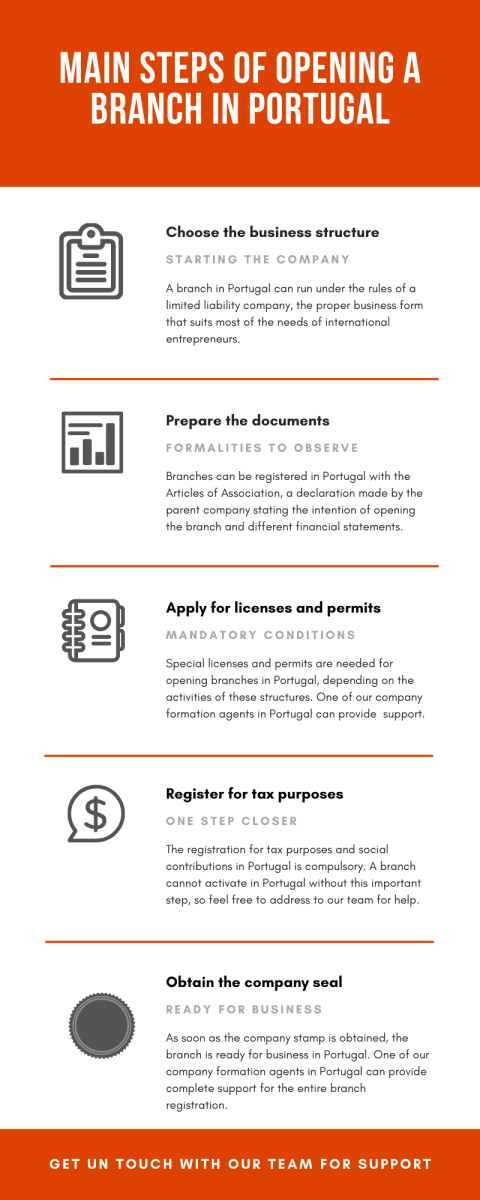

A branch needs to register the foreign company’s balance sheet and statements of losses and profits every year at the Portuguese Commercial Registry. The financial statements of the branch are kept separately and must be deposited on a yearly basis. If the country of origin has signed double tax treaties with Portugal, special incentives may be applied to the branch’s incomes, for example, the reduction or exemption of the withholding taxes on dividends, interests, and royalties or the refunding of the corporate taxes.

For this, the branch established in Portugal must bring evidence that those taxes are already paid in the foreign country. Here are a few facts to consider when opening a branch in Portugal in 2024:

- A branch in Portugal has the same treatment as a local company so the registration in the Commercial Registry is compulsory, with specific documents, different from the ones submitted by the national companies.

- A branch opened in Portugal must bring evidence that the foreign company is established in another country.

- The Articles of Association and the certificate of registration of the company abroad are also required.

- The list with the members of the management board and supervisory board must be presented at registration, if available.

Branches in Portugal can be set up in about 3 weeks. In the case of opening a corporate bank account for a branch in Portugal, the time frame is around 4 weeks. A great advantage is that there is no need for minimum share capital for such a structure.

Necessary information when registering a branch in Portugal

A branch in Portugal can run under the rules of a limited liability company or as a joint stock company, providing the following information:

- the name of the company, the type of business, and the registered address;

- a copy of the minute of the meeting where the decision of opening a branch was taken;

- the name of the branch and its address,

- the name of the person appointed to register the branch and the name of the branch’s representative,

- the type of activities that will be performed by the branch.

All the above must be written in Portuguese or accompanied by a Portuguese official translation. The registration at Commercial Registry comes with the issuance of the certificate of registration, the tax number, the VAT and the statistical number. Other requirements that a branch must fulfill before starting to operate a business in Portugal is to register at the Social Security Regional Center, the Labor Inspectorate, and at a private insurer for the workmen’s accident compensation insurance.

Among the company regulations imposed, one should note that at least 1 shareholder and 1 director are sufficient for opening a branch in Portugal. In the case of corporate income tax settled in Portugal, this is at a rate of 21%.

The documents for opening a branch in Portugal should be translated into Portuguese, English or French, as these languages are permitted in this sense. Otherwise, one should consider legalization, translation and notarization services prior the registration of a branch in Portugal.

Here is a video presentation about branches in Portugal:

Why open a branch instead of a subsidiary?

The registration procedure of a branch in Portugal is relatively simple compared to a subsidiary, meaning that there are fewer requirements, where the Articles of Association and the declaration of branch registration are mandatory. In the case of a subsidiary, the incorporation might seem complex because the investor needs to consider all the incorporation procedures of a company, from scratch. The accounting and the financial reporting for branches in Portugal are different from the ones for subsidiaries, the latter ones having to submit the annual financial reports. As for taxation of branches, these are subject to the corporate income tax of 21% as for any kind of local companies in Portugal. One of the important advantages of a branch in Portugal is that there is no need for a minimum share capital to deposit in a Portuguese bank account, just like in the case of subsidiaries.

Branches in Portugal present many advantages and among these, great tax benefits for foreign companies under certain conditions, fewer incorporation requirements, and no minimum share capital solicited. Moreover, Portugal is an appreciated financial center and has connections with solid financial markets worldwide.

Portugal is among the most popular business destinations in Europe. Starting from this aspect and if you plan to establish a company in this country, we recommend the services offered by our accountants in Portugal. Payroll, bookkeeping, preparation and submission of annual financial statements, as well as tax registration and returns are among the most important services offered. Therefore, contact us for more details on this topic.

FAQ about branches in Portugal

No, there is no obligation for you to travel to Portugal for establishing a branch, however, you may appoint one of our representatives, with a power of attorney, to act on behalf of your foreign company in this country. We remind that our consultants are at your service if you would like to set up a branch and need a legal representative. Let us tell you more about this matter.

Yes, all business entities, including branches, need to register for tax purposes and align with the taxation matters in this country. One needs to observe the corporate income tax and the VAT, two major taxes imposed in Portugal.

The Certificate of Good Standing of the foreign company, the Memorandum and the Articles of Association, a copy of the Certificate of Registration of the parent company, the minute of the General Meeting of the board of managers are a few of the necessary documents for establishing a branch in Portugal. In matters of formalities, the branch needs a legal representative with residency in Portugal.

Yes, it is important to hire the services of an accounting firm in Portugal if you would like to set up the operations as a branch. Before that, you will need to register for tax purposes, especially for VAT and social contributions. We remind that branches in Portugal are subject to annual tax filings.

Yes, a virtual office might be the proper solution for large companies from abroad that would, first of all, check up on the market and still have a professional business image with a notable business address and office in Portugal’s main cities. You should know that virtual office packages come with a virtual assistant, mail collecting and forwarding, phone and fax services, bank collection statements and many more.

The Conservatorias do Registro Comercial or the Commercial Registry is the institution in charge of company registration, including branches in Portugal.

Yes, it is important to appoint a representative agent and a board of managers for your branch in Portugal.

Yes, future financial operations need a bank account, therefore, it is mandatory to bear in mind this condition.

There is no specific duration for a branch in Portugal or for any company in this country, meaning that a company can perform the activities on indefinite time and no restrictions in this sense.

Yes, you can decide on the local workforce, and respect the Labor Law and the Employment Law in Portugal. If you choose to hire employers from other countries, you should observe the work permit rules for expats in Portugal.

The registration of branches in Portugal must respect the standards for international companies, and also corporate social responsibility, matters in which one of our local representatives can provide support.

Our company formation agents in Portugal are at your disposal if for more details related to branch registration in Portugal in 2024. Contact us for further information and personalized consultancy.