The process of company formation in Portugal requires completing some actions before the company is ready to begin its activity. It is necessary for the owner of the business to draft the articles of association and prepare all the other required documents, such as: passport copies, specimen signatures, and special forms. Some public notary procedures must also be taken care of as well as finding a registered office for company incorporation in Portugal. An accountant and a bank account are mandatory for company formation in Portugal. For a better understanding of the requirements, our team of company formation agents in Portugal is at your disposal with complete information and assistance.

| Quick Facts | |

|---|---|

| Types of companies | Limited liability company Joint stock company Limited partnership General partnership Branches of foreign companies Sole proprietorship |

| Minimum share capital for LTD Company | EUR 1 |

| Minimum number of shareholders for Limited Company | 2 |

| Time frame for the incorporation (approx.) | 2 weeks |

| Corporate tax rate | 21% |

| Dividend tax rate | 28% |

| VAT rate | 23%, a reduced rate of 13% also applies to certain goods |

| Number of double taxation treaties (approx.) | 52 |

| Do you supply a registered address? | Yes |

| Local director required | No |

| Annual meeting required | Yes |

| Redomiciliation permitted | Yes |

| Electronic signature | Yes |

| Is accounting/annual return required? | Yes |

| Foreign-ownership allowed | Yes |

| Any tax exemptions available? | Tax credits |

| Tax incentives | Regional incentives |

Our company, Lexidy Law Boutique SLP, provides a wide range of legal services, based on the support of a professional and experienced team of attorneys who speak English and German. Lexidy Law Boutique SLP was founded by Federico Richardson Alborna, an English-speaking lawyer in Spain registered at the Bar Association with the number 40.082.

Our affiliations

Lexidy Law Boutique SLP is part of the Camara de Comercio Hispano – Sueca de Barcelona (Sweden – Spain Chamber of Commerce in Barcelona), Il Lustre Col-Legi de L’advocaia de Barcelona (Barcelona Bar Association), the International Bar Association and Deutsch-Spanische Juristenvereinigung eV Hispano-German Association of Jurists (German-Spanish Association of Lawyers), prestigious institutions of high importance.

What types of business entities can you open in Portugal?

In order to incorporate a small or medium business with a reduced amount of capital and a liability limited by the contribution to the capital, the investors are advised to form a private limited company (sociedade por quotas – LDA) in Portugal. The LDA must be established by at least two founders with a minimum share capital of EUR 5,000. All the shareholders must bring a contribution to the capital and their liability is limited to that contribution. The management is assured by a director appointed by the general meeting of the shareholders, the supreme authority in the Portuguese LDA.

If the founders have a high amount of capital, they can incorporate a public company (sociedade anónima – SA) which is a legal entity for a large business created by investors who provide a minimum share capital of EUR 50,000. At least five shareholders are necessary to incorporate this type of business and their liability is limited to their contribution to the capital. In this type of Portuguese business, the management is assured by a board of directors which is monitored by a supervisory board, both invested by the general meeting of the shareholders.

We invite you to watch a short video about company incorporation in Portugal:

What is a limited partnership in Portugal?

The limited partnership (sociedade em comandita – SC) is formed by minimum two partners, at least one must be general and has full liability for the company’s obligations (socios comanditarias), while the other one will have limited liability and must deliver capital to the partnership (socios comanditados).

What is a general partnership in Portugal?

A general partnership (sociedade em nome collectivo – SNC) also has two partners with full liabilities in the firm. They are equally responsible for making decisions in the name of the entity and can manage the company. No minimum share capital is necessary for this type of business.

Have you planned to open a company? We recommend you use the services offered by our accountants in Portugal. In this country, Portuguese Accounting Standards and International Financial Reporting Standards are imposed, two very important sets of laws for any company with activities. Payroll, bookkeeping, tax returns, and annual financial statements are among the most important accounting services that a company needs.

What is an EIRL in Portugal?

Another form of business with no requirements for share capital is the company with a single shareholder (EIRL). The founder of such company is liable with his/her personal assets for the entity’s debts.

Information comprised by the Articles of Association

The Articles of Association are the company’s main documents needed for company formation in Portugal which contain complete information about:

- the name of the company you want to set up in Portugal;

- the name of the shareholders, their nationality and the country of residence;

- the future activities ofthe newly-opened company in Portugal;

- the responsibilities and the rights of directors managing the company;

- the transferability of shares and the assignment of the rights of shareholders;

- the voting rights in the company and details about the dissolution procedure.

We remind that our team of specialists in company incorporation in Portugal are at your disposal with complete assistance when drafting and submitting the Articles of Association for your business in Portugal.

How can I open an LDA in Portugal?

Foreign investors who want to register a limited liability company in Portugal, known as LDA, the most popular business structure in Portugal, need to provide a minimum share capital of EUR 5,000 in a bank account opened in this country. Such type of business can be opened by at least one shareholder in Portugal, without the obligation of having a board of managers in the firm. We remind that a limited liability company in Portugal is created with respect to the Company Act in Portugal and the Commercial Code. We are at your disposal with legal support when creating the documents of the firm and registering them with the entitled authorities.

Incorporation procedure in Portugal

It is mandatory that the name of the newly formed company in Portugal is checked at the National Registry of Collective Entities (Registro Nacional de Pessoas Colectivas, RNPC). If the name is available, it can be reserved for a period of 48 hours if a fee is paid. Also, a pre-approved name can be elected from the RNPC database.

In order to obtain a certificate of registration, the founders of an entity must submit an application followed by the articles of association and the certificate of the name approval, but no later than 15 days from the incorporation. When receiving the above, the Portuguese authority will deliver the corporate tax number, the company’s social security number and the declaration of commencement of business activities. The entity’s employees must be registered at the Centros de Formalidades das Empresas or at the Business Registry Office 24 hours before they start their activity or 10 days at the latest after the declaration of starting the business.

The Labor Inspectorate must also be notified regarding its existence by providing the newly formed business name and tax number, a copy of the published announcement regarding the company incorporation, the company’s activities and the headquarter address. The registration for the employees’ accident compensation insurance is performed online at a private insurer and cannot cover the individual which doesn’t receive a salary.

If you are would like to know details about the incorporation pprocedure in a different country, for example in the Philippines, our partners can give you details.

Steps for opening a company in Portugal

Public and private limited liability companies can be easily set up in Portugal, following these steps:

1. Verify the business name and make a reservation with the Portuguese Trade Register.

2. Appoint a legal representative for your company in Portugal.

3. Draft the Articles of Association with information about the owners, business activities, etc.

4. Open a bank account for depositing the minimum share capital of EUR 5,000.

5. Apply for licenses and permits in accordance with the company’s activities.

6. Register for tax purposes and social contributions in Portugal.

Company formation costs in Portugal

Here is information about the business start-up costs you need to consider in Portugal:

1. Registration fee: maximum EUR600 for a pre-approved business name, company documents, certificate, etc.

2. Virtual office costs: around EUR 50 per month for a complete virtual office package.

3. Minimum share capital: EUR1 per share, but we suggest at least EUR3,000 for opening an LDA in Portugal.

4. Company formation fee: from EUR1,000

5. Accounting costs: starting from EUR150 plus VAT per month for varied accounting services.

Shelf companies in Portugal

If you would like to skip the formalities of opening a company from scratch, the best option is to purchase a shelf company. Also known as a ready-made company, this is an already registered firm which is kept on a ”shelf” until it ages and until someone is interested in it. Having no financial activities and therefore no liabilities, a shelf company in Portugal can easily access loans from the local banks. It is good to know that a ready-made company in Portugal can activate on the market as soon as the ownership transfer is made. You can rely on our team for company formation procedures, including the ones for a shelf company in Portugal.

Virtual office services

Entrepreneurs from abroad who are interested in opening a company in Portugal should know that they can benefit from virtual office packages. Such services involve a prestigious business address in Lisbon or in any large city in Portugal, mail collection and forwarding in respect to the clients’ needs, a local phone number plus fax and voice message services on request. Extra usage of meeting rooms and bank statements collection can be provided at the time you are interested in virtual office services in Portugal. You may talk to our consultants for additional information in this matter

Can I establish a branch in Portugal?

Yes, companies from abroad can rapidly establish a branch in Portugal which can run under the rules of a limited liability company or LDA as it is known. Opening a branch in Portugal comes with a series of requirements like submitting the parent company’s documents, the statements of profits and losses, balance sheets and any other papers requested by the Portuguese Trade Register. Branches in Portugal can benefit from the double taxation treaties signed with countries worldwide if proof that the taxes have been paid in the parent company’s country of residence is offered to the authorities.

Can I establish a subsidiary in Portugal?

Yes, foreign enterprises can set up subsidiaries in Portugal. Just like in the case of branches, these can be formed as limited liability companies with a minimum share capital of EUR 5,000 for a private entity or EUR 50,000 for a public LLC. The foundation deeds and the Articles of Association are the important documents of a subsidiary in Portugal. We remind that a subsidiary is an independent entity that has to register for tax purposes in Portugal. Our team can also handle such type of business registration.

Information found in the Commercial Registry of Portugal

Since the Portuguese Trade Register also records information about companies, there are certain acts or documents that these corporations must also register aside from the articles of association. Our lawyers in Portugal have noted down the information you must provide:

- when the law requires, the decision to purchase goods by the company must be registered;

- appointments and dismissals of members of the board of directors;

- merger or division plan;

- issuance of stock warrants;

- dismissals and exclusions of shareholders;

- changes in the articles of association.

Once the company incorporation is made, the VAT registration is needed. One of our lawyers in Portugal can give full support in this matter and can also help you obtain the EORI number.

Company modifications need to be announced

If your company suffers modifications like changing the company structure or replacing the board of managers, for example, you should notify the Portuguese Trade Register right away. The same institution is in charge of mergers and acquisitions, modifications of contractual clauses, share capital changes, company restructuring, company dissolution, and many more.

Can I make a name verification with the Portuguese Trade Register?

Yes, the first thing to consider when starting a business in Portugal is to make a name verification and see if you can legally register your future company. The Trade Register in Portugal handles the company name verifications by providing online access to those interested in this kind of service. We advise foreign investors to pay attention to the name verification for companies in Portugal and skip any possible infringements in terms of intellectual property and many more. Feel free to talk to our lawyers in Portugal about this aspect.

Frequently asked questions

Local and foreign entrepreneurs over 18 years of age and with sufficient funds to comply with the minimum share capital for a company can start and register a business in Portugal. With support offered by our consultants, you can easily incorporate your company in Portugal.

Private and public limited liability companies, limited and general partnerships, joint stock companies or sole proprietorships are the most important business structures that can be established in Portugal.

The Portuguese LDA or the limited liability company is the most common business structure which is chosen by most of the investors from overseas looking to benefit from a well-known structure on an international scale.

The incorporation of an LDA in Portugal starts at the Commercial Registry in Portugal and the local offices. If the Articles of Association, which comprise complete information about the owners and the future activities, are submitted to the Commercial Registry, then the incorporation process has started.

Opening an LDA in Portugal requires a minimum share capital of EUR 5,000 deposited in a Portuguese bank account. If you need assistance in drafting the documents for your business in Portugal and for opening a bank account, please address your inquiries to our team of consultants.

Yes, foreign companies can easily open a branch or a subsidiary in Portugal, in respect to the applicable legislation. We mention that investors from abroad have the same business rights as the domestic entrepreneurs, as there is a permissive legislation related to foreign investments.

Yes, foreign investors can ask for accounting services in Portugal and benefit from an experienced team in charge of payroll, bookkeeping, annual financial statements, tax management and many more.

Yes, you can decide on purchasing a shelf company in Portugal which is a ready-made company that can be active on the market as soon as the ownership transfer is completed. A shelf company has no financial activities and therefore no liabilities.

Yes, for specific activities like gambling or financial services, the entrepreneurs need to apply for different licenses and permits. It is recommended to ask us about the requirements as we can provide complete support and information.

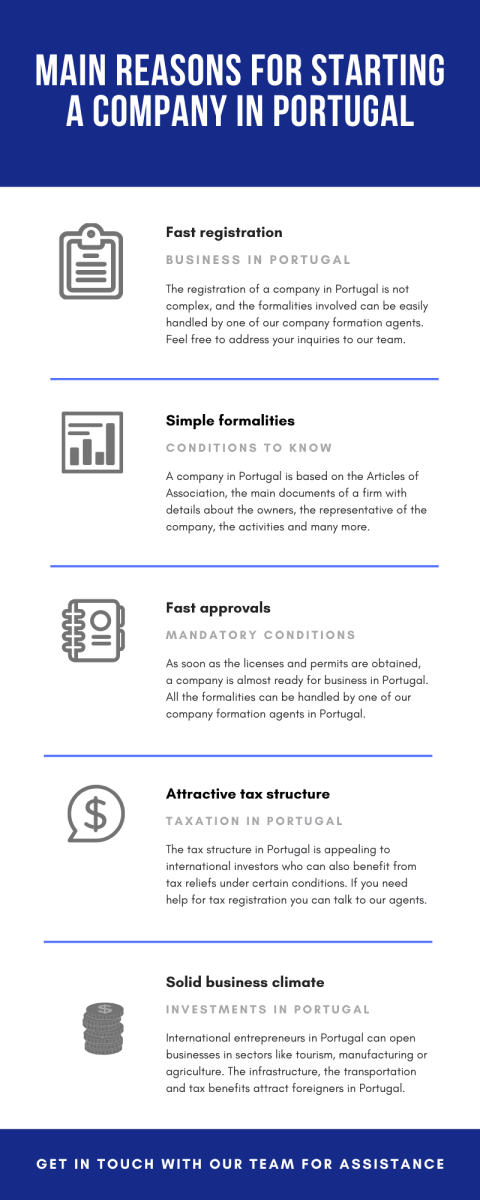

Because the incorporation procedure is not time-consuming and the requirements are less bureaucratic, international investors can easily set up their companies and commence their activities.

Economy overview in Portugal

Portugal’s economy is mainly based on agriculture, tourism, and trade. As a matter of fact, Portugal is an important partner in international trading. Besides, Portugal is well-known for its production of cork, oak and olive oil. Incentives are offered for foreign company formation in Portugal, such as the development of renewable energies, specifically solar energy. Moreover, foreign investors willing to set up a company in Portugal can ask for help from the Agency for Investments and External Commerce in Portugal in order to find out more about the company formation in Portugal. The main investors in Portugal are from: Germany, UK, Spain, France and the Netherlands.

For more details related to company incorporation in Portugal, get in touch with our local specialists. If you are interested in company formation services in other countries, like Belgium or Hong Kong, please don’t hesitate to contact our partners.