Deciding on a business in Portugal as a foreign investor can imply finding a suitable business form and that is the private limited liability company or LDA as it is known. Most of the activities can be implemented and developed in Portugal with the help of such a simple business structure that is in the attention of many entrepreneurs looking to generate profits in this part of Europe. Our company incorporation agents in Portugal are at the disposal of investors who are interested in opening an LDA in Portugal.

What is a Portuguese LDA?

A Portuguese LDA comes from a private limited liability company in Portugal, also known as quota or sociedade por quotas de responsabilidade limitada. This is the most common type of business structure in Portugal, especially for small and medium-sized companies.

One should note that an LDA in Portugal can be set up in approximately 2-4 weeks, while the corporate bank account takes around 4 weeks. One of our local agents can manage the procedures for the incorporation of such a structure. In other European countries, such as Italy, it may take less than 7 working days to open an LLC.

What is the minimum share capital for an LDA in Portugal?

In order to set up a Portuguese LDA, a minimum share capital of EUR 5,000 is mandatory. This capital is divided into shares and the minimum value for each share is EUR 100. We remind that the capital contributions can be made in cash or in kind. One should know that half of the initial capital in cash has to be paid up prior to incorporation, while the assets must be evaluated by an auditor and then paid in full.

The minimum share capital differs from one country to another, for example in the neighboring country Spain, you need to submit EUR3,000 to open an LLC.

How many shareholders are necessary for an LDA in Portugal?

A Portuguese private limited liability company can be set up by at least one shareholder, regardless of the nationality or residency. If only one founder decides to set up a company, the structure is called sociedade unipessoal por quotas or SUQ. It is good to know that the shareholders are only liable to the extent of their contributions to the company.

Our accountants in Portugal offer complete services to company owners in this country. We remind you that it is important to benefit from services such as payroll, bookkeeping, HR management, tax registration, and returns. Also, our specialists can take care of the preparation and submission of the annual financial statements of a firm in Portugal. Risk assessment and evaluation is a service that can be offered on request.

What is the management structure of an LDA in Portugal?

The Company Law in Portugal does not mention the obligation to form a board of directors for a Portuguese LDA. The management role can be performed by a managing director who is appointed by the shareholders. On the other hand, the shareholder can also be the director of the firm who will be in charge of the decisions, operations and business direction of the company. If a director is appointed separately, he/she cannot make all decisions, therefore a general meeting has to be organized from time to time.

The registration of an LDA in Portugal costs around EUR 270 or more which includes varied fees. Once the process is done, the business owner receives the Articles of Association, Social Security Number, Permanent Certificate, etc.

LDAs in Portugal can develop a wide range of economic activities. Such operations are normally specified by the Memorandum of Association, in details. Our local agents can tell you more about how to prepare this kind of document when opening a LDA in Portugal.

Choosing the name for your LDA in Portugal

The name of the private limited liability company is registered with the National Registry of Companies in Portugal. At the time you choose the name of your business, it is recommended to make a name verification in this sense and to propose three names. As a mandatory condition, the chosen and approved name must contain “Sociedad por Quotas” at the end of it or simply Lda. It is good to know that the authorities accept the name of the business in any language as long as it respects the above-mentioned requirement. One of our specialists can give information about business formalities in Portugal in 2024.

LDAs in Portugal are subject to a corporate tax rate of 21%. The VAT in Portugal is set at a standard rate of 23% and 22% rate in the autonomous region of Madeira and 16% in the Autonomous Region of Azores.

The registered office of your LDA

All LDAs in Portugal must have a registered office address in order to receive the company’s tax form, bills, and many more. The accounting records of your firm will be kept at the registered and declared business office in Portugal.

LDAs in Portugal can have more than 2 shareholders or members. However, sole traders in Portugal can choose the individual limited liability establishment or Unipessoal, as it is called. You can select this kind of structure and register it with the support of our local agents in Portugal.

How can an LDA be verified in Portugal?

Auditing is not compulsory for a Portuguese LDA. It is, however, recommended to have a supervisory board for the private limited liability company in Portugal if the total balance sheet exceeds EUR 1,5 million in two consecutive years, if the net sales exceed EUR 3 million or if the number of employees is higher than 50.

Are there other requirements for an LDA in Portugal?

The name of a private limited liability company in Portugal must contain the word limitada or at least the letters LDA. Foreign investors can appoint a legal representative through power of attorney in order to deal with the company registration in Portugal.

It is good to note that Portugal imposes a corporate tax rate of 21%. However, a corporate tax rate of 17% is imposed for the first EUR 15,000 while the remainder is taxed at 21% tax rate, which is the standard corporate tax rate in Portugal.

The benefits of LDAs in Portugal

Private limited liability companies in Portugal address to both foreign and local entrepreneurs wanting to operate on the market with the help of a simple form of business. The incorporation process of an LDA in Portugal is less restrictive and has fewer formalities. Moreover, the shares in an LDA can be 100% owned by a foreigner, meaning that there is no need for a local investor to create the business. It is good to know that there is no need for audits if the company is small or medium. Requiring only one shareholder for creating an LDA in Portugal is another reason why investors from overseas decide on such a business structure, and more than that, the shareholder can be the director of the firm. Portugal is among the European countries that offer the possibility of creating a company with low capital, in this case, EUR 5,000 for an LDA.

The double taxation treaties signed by Portugal with countries worldwide protect foreign investors from paying the taxes twice on incomes and offer a series of tax advantages. LDAs are the most popular business structures in Portugal and on top of the list of investors who are interested in complete control in their company, an easy incorporation, an attractive minimum share capital and the option of collaborating in terms of business with companies worldwide in a reliable and easy manner. Understanding better the conditions for opening an LDA in Portugal can help foreigners commence the activities in this country within a few days, therefore, you may address your inquiries to our team of consultants.

Buying a shelf company in Portugal in 2024

The purchase of a shelf company in Portugal is quite simple and often the choice of local and foreign entrepreneurs interested in starting a business without having to wait for the entire registration process. Things are quite simple with a vintage company because this is already incorporated in Portugal and kept on a shelf until someone buys it. The purchase of a ready-made company in Portugal can be handled by one of our specialists who will accept the required documents and then continue with the formalities. LDA is the proper structure for shelf companies in Portugal.

In matters of advantages, a shelf company presents complete confidence because it is registered with the Company Registry in Portugal and has no activities on the market. Yet, if an entrepreneur wants, a company verification can be made, to make sure the shelf company has no liabilities or financial debts left behind. Ready-made companies can be purchased right away, without for the entrepreneur to travel to Portugal. Plus, the operations can start right away because the shelf company is ready for business. You can discuss with our agents and find out more about LDAs and shelf companies in Portugal.

Guide for starting a business in Portugal

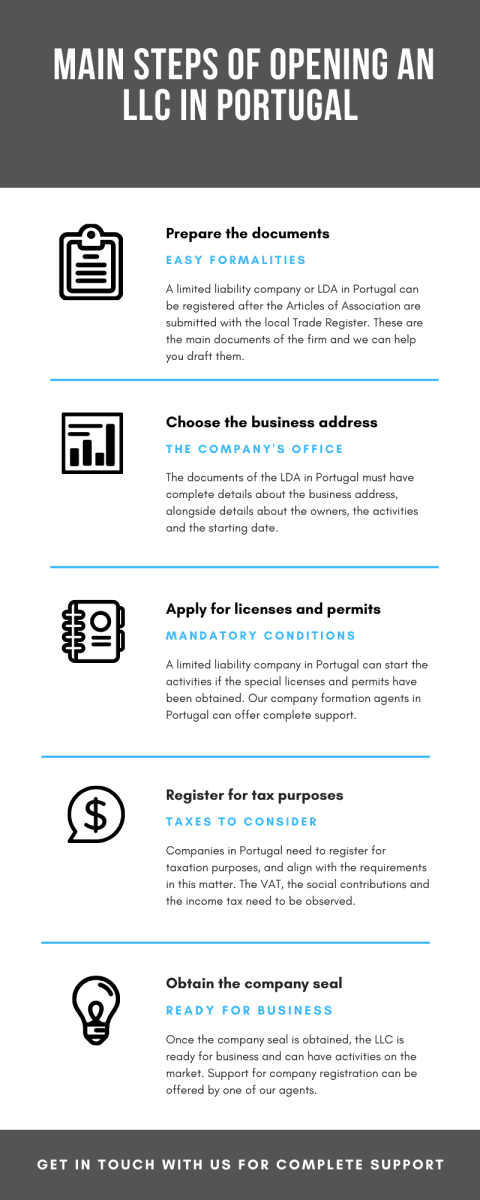

As mentioned in this article before, the limited liability company or LDA is the proper business choice of domestic and international entrepreneurs in Portugal. Being a simple business structure, an entrepreneur can start the activities quite fast, as soon as the registration for taxation is made. We present you a short guide to help you understand how you can start a business in Portugal in 2024, without complications and with complete support offered by our specialists in Portugal:

- The activities of the future firm are usually established from the beginning by the business owners.

- The minimum share capital of EUR 5,000 needs to be deposited in a Portuguese bank account.

- Once you selected the name for the business, you must make a reservation with the Portuguese Company Registry.

- If your activities require a specific business license, you need to make the necessary arrangements. Our agents can help you.

- The registration for taxes and social contributions can be made with our support.

- All the documents need to be drafted to the Portuguese Trade Register for approval.

- Once accepted, you can apply for a company stamp and get ready for business.

The registration formalities for LDA in Portugal have been simplified in recent years, allowing foreigners to enjoy a fast start on the market. There is also the ‘Empresa online” procedure that refers to the incorporation of a company on the internet, under the observation of the National Registry of Companies in Portugal. You can also be guided by one of our specialists in company formation in Portugal if you want to know more about this kind of company formation.

Making investments in Portugal

Portugal is open for business and it is home to many international companies with different activities. The LDA is the most suitable business structure for foreigners due to the lack of registration complexities, representing a great business advantage. Besides this important benefit, international entrepreneurs enjoy a proper and appealing business climate, with encouragements in matters of taxation offered by the Portuguese government, relaxed investment legislation, a skilled workforce, plus a great infrastructure that combines the business worldwide.

Startups in Portugal are quite encouraged in Portugal, particularly in sectors like education, medicine, transportation, tourism, research, and development. The tax regime is appealing to entrepreneurs in Portugal, plus, the profits are protected by a number of double taxation agreements signed with countries worldwide to avoid fiscal evasion and any other financial risk. The following facts and figures highlight a part of the economy and business direction of Portugal at the moment:

- The total FDI stock for Portugal in 2021was approximately USD 175 billion.

- Making investments of at least EUR 350,000 grants the entrance to the Golden Visa Programme in Portugal.

- 161 was the number of greenfield investments registered in Portugal in 2021, worth around USD 3,4 billion.

- Portugal ranks 39th out of 190 economies in the world, according to the 2020 Doing Business report.

For more details on the characteristics of an LDA, our Portuguese company formation specialists remain at your service. Please feel free to contact us for a personalized consultancy.